Fourth-quarter 2015 refinery outage report released

EIA has issued a report on expected fourth-quarter refinery outages and their potential implications for the availability of gasoline and distillate supply at the Petroleum Administration for Defense District (PADD) and sub-PADD levels. This report analyzes the availability of refinery capacity to produce diesel fuel and heating oil (distillate) and gasoline, focusing on two refinery units, the atmospheric crude distillation unit (ACDU) and the fluid catalytic cracking unit (FCCU), which are strongly correlated with distillate and gasoline production, respectively. In addition, data for planned maintenance on catalytic reforming units (CRU) and hydrocracking units (HU) are provided. The report also contains a discussion of current market conditions and average historical unplanned outages.

Refinery outages result from the planned shutdown of refinery units for maintenance and upgrades, and from unplanned shutdowns from a variety of causes such as mechanical failure, bad weather, power failures, fire, and flooding. Planned maintenance is typically scheduled when refined petroleum product consumption is relatively low.

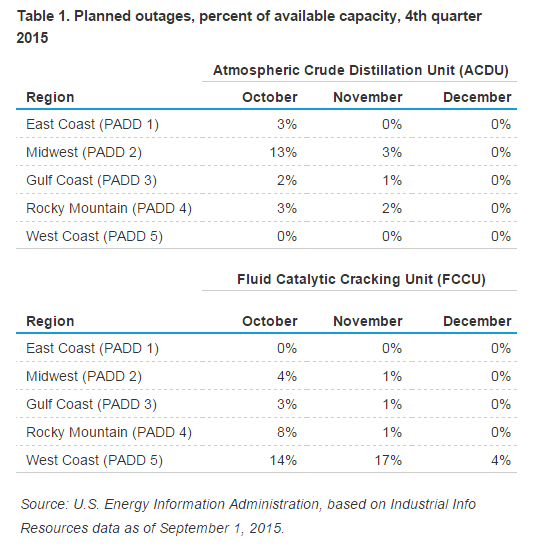

Across the different regions of the country, fourth-quarter 2015 planned refinery maintenance is concentrated in October, and many refineries have returned to or are in the process of returning to normal operations. Less maintenance is planned for November and minimal maintenance is planned for December. Table 1 provides a by-PADD, by-month summary of the percentage of available refining capacity expected to be out of service for maintenance during October through December.

Source: U.S. Energy Information Administration, based on Industrial Info Resources data as of September 1, 2015.

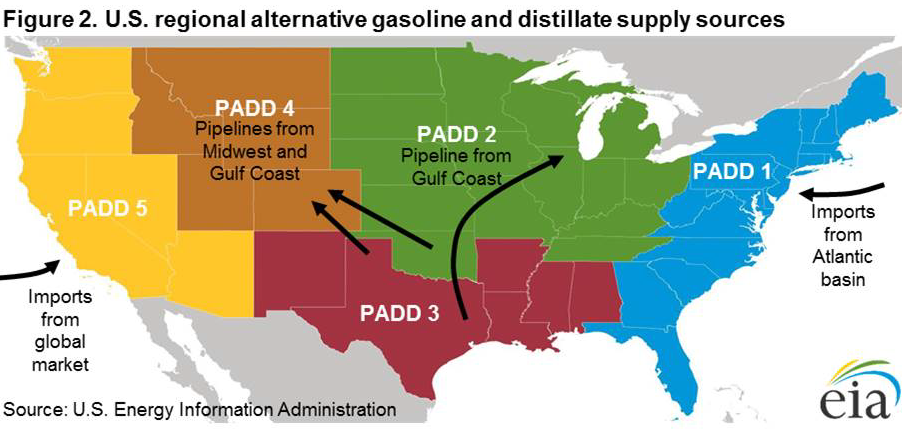

In most regions, fourth-quarter planned maintenance is light compared to last year as well as to historical levels. However, in the Midwest, 13% of ACDU capacity is expected to be offline for maintenance in October. After generally staying above the five-year range for much of 2015, PADD 2 ACDU gross inputs fell off sharply in early October. For the week ending October 9, the rolling four-week average for PADD 2 gross inputs was 209,000 barrels per day (b/d) lower than the five-year average. Despite the decrease in gross inputs, distillate inventories remain above the five-year average for this time of year and gasoline inventories are similar to where they were last year. While Midwest refineries supply most of the distillate fuel and gasoline that is consumed in the region, the Midwest also receives products from the Gulf Coast, including supplemental supply during disruptions.

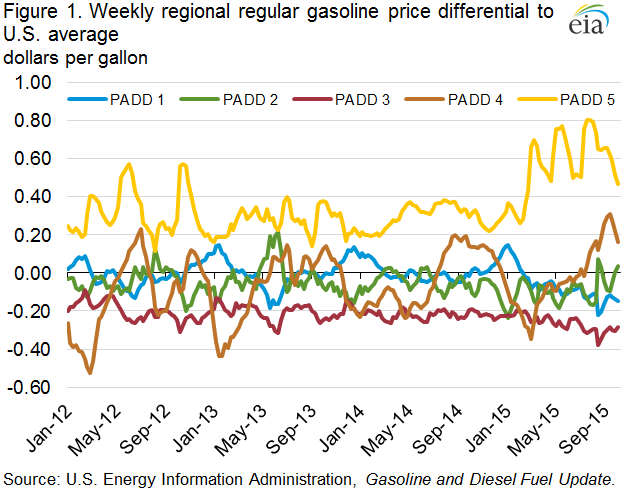

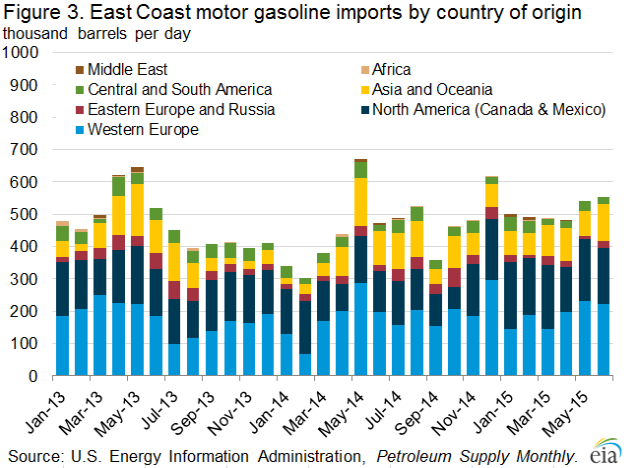

PADD 5 (West Coast) planned ACDU maintenance is minimal over the period, but planned FCCU maintenance in October and November is more than 50,000 b/d higher than the 10-year average and more than 25,000 b/d higher than the 10-year maximum. The ongoing unplanned FCCU outage following the February 18 explosion at the ExxonMobil refinery in Torrance, California, has continued to put upward pressure on gasoline prices in the region. Imports of total motor gasoline to California ranged between 28,000 b/d and 68,000 b/d in March through July, compared with an average of 5,000 b/d in 2013-14. Further outages, either planned or unplanned, would exacerbate the supply situation. PADD 5 gasoline inventories declined steadily during the summer driving season, reaching a multiyear low of 25.7 million barrels on August 21. Since then, gasoline inventories have rebuilt and have been above the five-year average since September 11. Distillate inventories have been above the five-year average for much of the year.

U.S. average retail gasoline and diesel fuel prices decrease

The U.S. average retail price for regular gasoline declined six cents from last week to $2.28 per gallon on October 19, down 84 cents per gallon from the same time last year. The Midwest price fell 11 cents to $2.30 per gallon, followed by the Rocky Mountain price, which was down seven cents to $2.36 per gallon. The West Coast and Gulf Coast prices each fell five cents, to $2.70 per gallon and $2.00 per gallon, respectively. The East Coast price decreased three cents to $2.17 per gallon.

The U.S. average diesel fuel price decreased three cents from the previous week to $2.53 per gallon, down $1.13 per gallon from the same point last year. The Rocky Mountain price posted the lone price increase, up less than one cent to remain $2.52 per gallon. The Midwest, East Coast, and West Coast prices each decreased three cents, to $2.60 per gallon, $2.52 per gallon, and $2.70 per gallon, respectively. The Gulf Coast price was down one cent to $2.33 per gallon.

Propane inventories fall

U.S. propane stocks decreased by 0.6 million barrels last week to 101.6 million barrels as of October 16, 2015, 20.0 million barrels (24.5%) higher than a year ago. Gulf Coast inventories decreased by 0.5 million barrels and Midwest inventories decreased by 0.3 million barrels. Rocky Mountain/West Coast inventories increased by 0.1 million barrels while East Coast inventories remained unchanged. Propylene non-fuel-use inventories represented 4.4% of total propane inventories.

Residential heating oil price decreases while propane remains unchanged

As of October 19, 2015, residential heating oil prices averaged nearly $2.43 per gallon, 1 cent per gallon lower than last week and $1.05 lower than one year ago. The average wholesale heating oil price this week is $1.60 per gallon, 10 cents less than last week and $1.05 per gallon less than a year ago during the same week of the 2014-2015 heating season.

Residential propane prices averaged $1.90 per gallon, less than 1 cent per gallon higher than last week’s price and 49 cents lower than one year ago. Wholesale propane prices averaged 54 cents per gallon, 4 cents per gallon lower than last week’s price and 53 cents lower than the price on October 20, 2014.

For questions about This Week in Petroleum, contact the Petroleum Markets Team at EIA.gov