East Coast, Gulf Coast trade transportation fuels to balance needs, supply

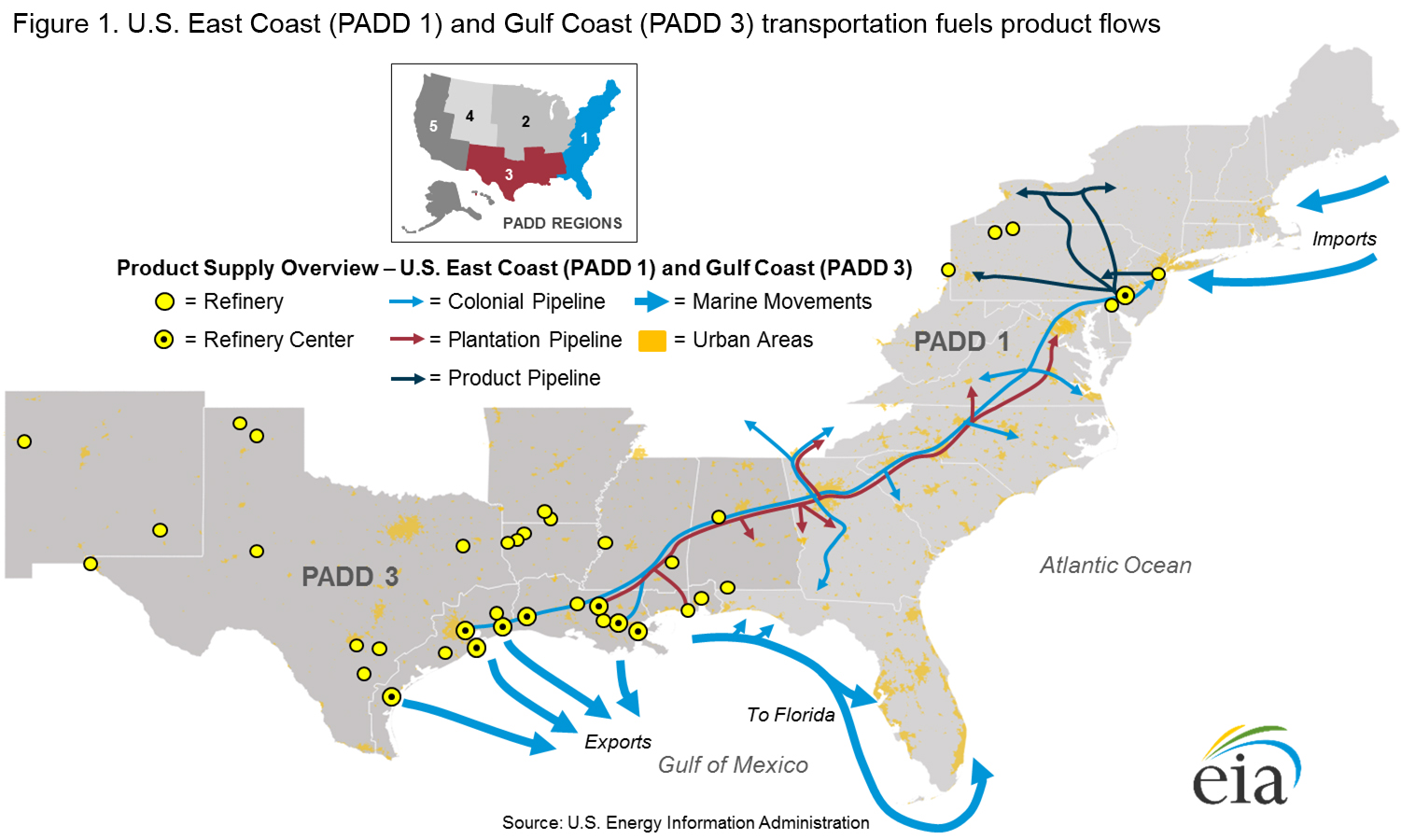

With just over half of total U.S. refining capacity, the Gulf Coast (Petroleum Administration for Defense District, or PADD, 3) is the largest domestic supplier of transportation fuels. Regional consumption is less than one-third of in-region production. The East Coast (PADD 1) is the largest transportation fuels consuming region in the country. However, that region’s limited refinery capacity produces transportation fuels to meet just one-fifth of regional consumption. Pipeline infrastructure linking the two PADDs and international trade play key roles in balancing the mismatch between the supply and use of transportation fuels within each region (Figure 1).

On February 3, the U.S. Energy Information Administration (EIA) released aPADD 1 and 3 Transportation Fuels Markets study, which examines transportation fuels (motor gasoline, distillate fuel, and jet fuel) supply, consumption, and distribution at both the PADD level and for specific areas within the PADDs.

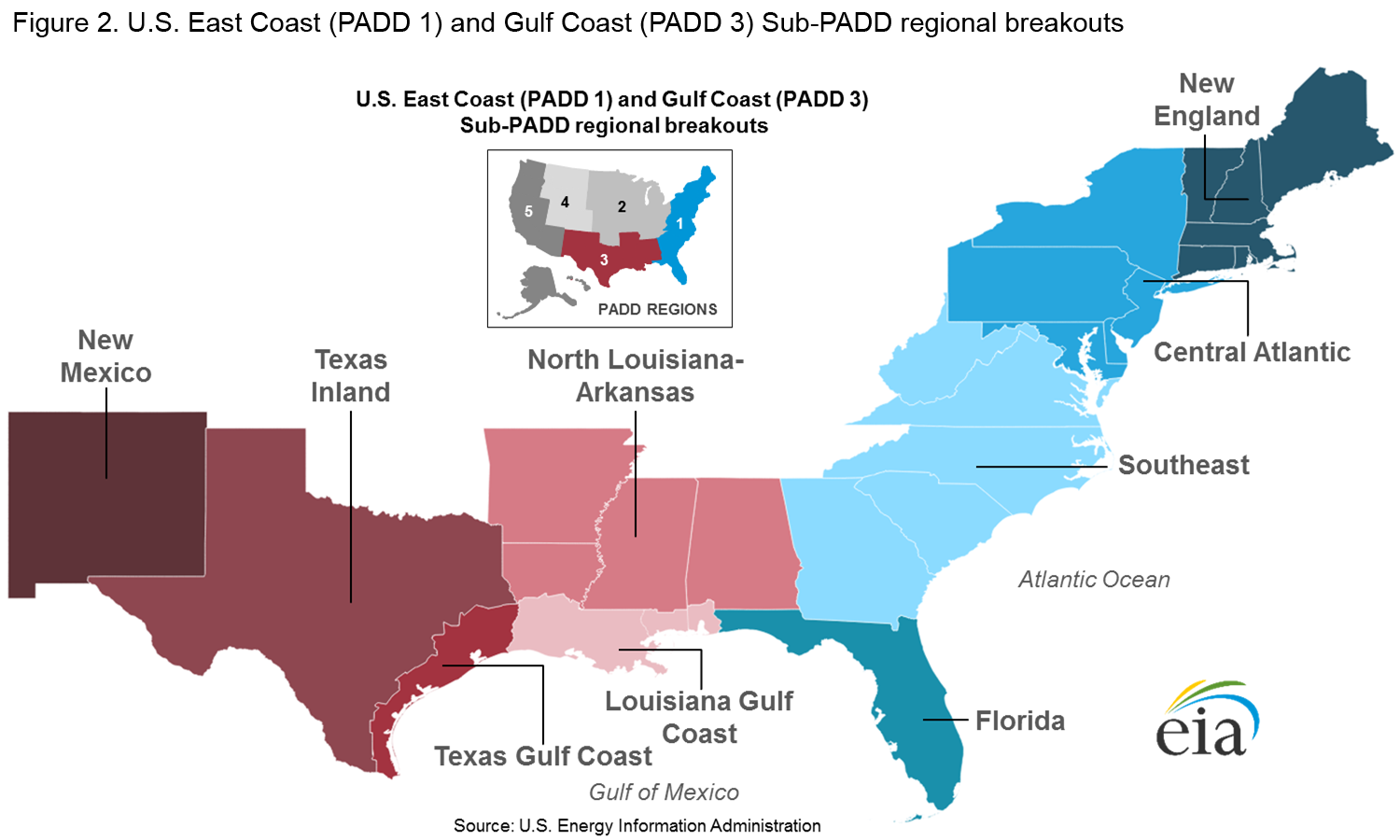

The East Coast region includes states from Maine to Florida along the U.S. Atlantic Coast. The Gulf Coast region comprises states between New Mexico in the west to Alabama in the east, primarily along the Gulf of Mexico. For this study, transportation fuels include gasoline, distillate fuel (including diesel), and jet fuel. Residual fuel oil supply is also analyzed where applicable.

The study considers the East Coast as four distinct regions: New England (PADD 1A), Central Atlantic (PADD 1B), the Southeast, and Florida. The Gulf Coast is divided into five regions: New Mexico, Texas Inland, Texas Gulf Coast, Louisiana Gulf Coast, and North Louisiana-Arkansas (Figure 2).

The study examines transportation fuels supply, consumption, and distribution patterns within the specific sub-PADD regions. The study evaluates the supply, storage, and distribution of transportation fuels from in-region refineries and other domestic sources of supply as well as imports. The study characterizes the infrastructure associated with the distribution of transportation fuels including infrastructure associated with refineries, bulk terminals, pipelines, marine movements, as well as transportation fuel distribution patterns. The study also considers regional supply/demand balances and includes a discussion of the wholesale and retail market structure for each region.

This study is the second in a series by EIA to inform its analyses of petroleum product markets, especially during periods of supply disruptions and market change. A previously published study analyzed PADD 5 (West Coast) transportation fuels markets. Planned studies will analyze PADD 5 crude supply and the transportation fuels markets in the Midwest (PADD 2) and Rocky Mountains (PADD 4).

U.S. average retail regular gasoline and diesel fuel prices decrease

The U.S. average retail price for regular gasoline decreased three cents from the previous week to $1.82 per gallon on February 1, 2016, down 25 cents from the same time last year. The West Coast price decreased eight cents to $2.38 per gallon, followed by the Rocky Mountain price, which decreased six cents to $1.80 per gallon. The Gulf Coast price was down four cents to $1.59 per gallon. The East Coast price decreased three cents to $1.84 per gallon, and the Midwest price was down one cent to $1.62 per gallon.

The U.S. average diesel fuel price decreased four cents from last week to $2.03 per gallon, down 80 cents per gallon from the same time last year. The West Coast, Rocky Mountain, and Midwest prices each fell five cents to $2.27 per gallon, $1.97 per gallon, and $1.94 per gallon, respectively. The Gulf Coast price was down four cents to $1.92 per gallon. The East Coast price decreased three cents to $2.11 per gallon.

Propane inventories fall

U.S. propane stocks decreased by 5.6 million barrels last week to 78.1 million barrels as of January 29, 2016, 10.8 million barrels (16.1%) higher than a year ago. Gulf Coast inventories decreased by 3.1 million barrels, Midwest inventories fell by 1.3 million barrels, and East Coast and Rocky Mountain/West Coast inventories each declined by 0.6 million barrels. Propylene non-fuel-use inventories represented 4.1% of total propane inventories.

Residential heating fuel prices increase

As of February 1, 2016, residential heating oil prices averaged $2.08 per gallon, nearly 2 cents per gallon higher than last week and almost 72 cents lower than last year’s price for the same week. The wholesale heating oil price this week averaged $1.14 per gallon, almost 8 cents higher than last week and nearly 69 cents per gallon lower than a year ago.

Residential propane prices averaged $2.02 per gallon, less than a penny per gallon higher than last week’s price and almost 35 cents lower than one year ago. Wholesale propane prices averaged 46 cents per gallon, just over 2 cents per gallon higher than last week and almost 15 cents per gallon lower than last year.

For questions about This Week in Petroleum, contact the Petroleum Markets Team at EIA.gov