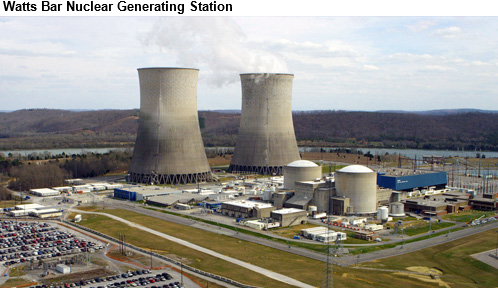

Source: Republished with permission from the Tennessee Valley Authority

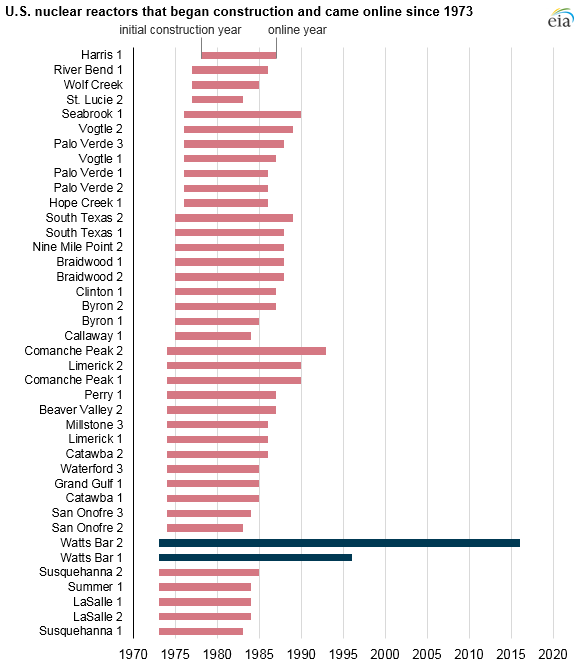

The Tennessee Valley Authority’s (TVA) Watts Bar Unit 2 was connected to the power grid on June 3, becoming the first nuclear power plant to come online since 1996, when Watts Bar Unit 1 started operations. Watts Bar Unit 2 is undergoing final testing, producing electricity at incremental levels of power, as TVA prepares to start commercial operation later this summer. The new reactor is designed to add 1,150 megawatts (MW) of electricity generating capacity to southeastern Tennessee.

Watts Bar Unit 2 is the first nuclear plant in the United States to meet new regulations from the U.S. Nuclear Regulatory Commission (NRC) that were established after the 2011 earthquake and tsunami that damaged the Fukushima Daiichi Nuclear Plant in Japan. After the NRC issued an operating license for the unit in October 2015, 193 new fuel assemblies were loaded into the reactor vessel the following month. TVA announced at the end of May that the reactor achieved its first sustained nuclear fission reaction.

Construction on Watts Bar Unit 2 originally began in 1973, but construction was halted in 1985 after the NRC identified weaknesses in TVA’s nuclear program. In August 2007, the TVA board of directors authorized the completion of Watts Bar Unit 2, and construction started in October 2007. At that time, a study found Unit 2 to be effectively 60% complete with $1.7 billion invested. The study said the plant could be finished in five years at an additional cost of $2.5 billion. However, both the timeline and cost estimate developed in 2007 proved to be overly optimistic, as construction was not completed until 2015, and costs ultimately totaled $4.7 billion.

Although Watts Bar 2 is the first new U.S. nuclear generator to come online in 20 years, four other reactors are currently under construction and are expected to join the nuclear fleet within the next four years. Vogtle Electric Generating Plant Units 3 and 4 in Georgia and Virgil C. Summer Nuclear Generating Station Units 2 and 3 in South Carolina are scheduled to become operational in 2019–20, adding 4,540 MW of generation capacity.

Principal contributors: Sara Hoff, Marta Gospodarczyk